Utah Sales Tax Exemption Nonprofit . Many nonprofits can benefit from being exempt from sales tax on purchases of services, goods, and materials. Federally exempt 501(c)(3) organizations must obtain an n number (sales tax exemption number) from the utah state tax commission. Under utah law, a religious or charitable organization is exempt from sales tax at the point of sale when it makes purchases. Such entities include state and local government entities, federal. Utah allows certain types of entities to be exempt from sales tax.

from www.formsbank.com

Utah allows certain types of entities to be exempt from sales tax. Federally exempt 501(c)(3) organizations must obtain an n number (sales tax exemption number) from the utah state tax commission. Such entities include state and local government entities, federal. Under utah law, a religious or charitable organization is exempt from sales tax at the point of sale when it makes purchases. Many nonprofits can benefit from being exempt from sales tax on purchases of services, goods, and materials.

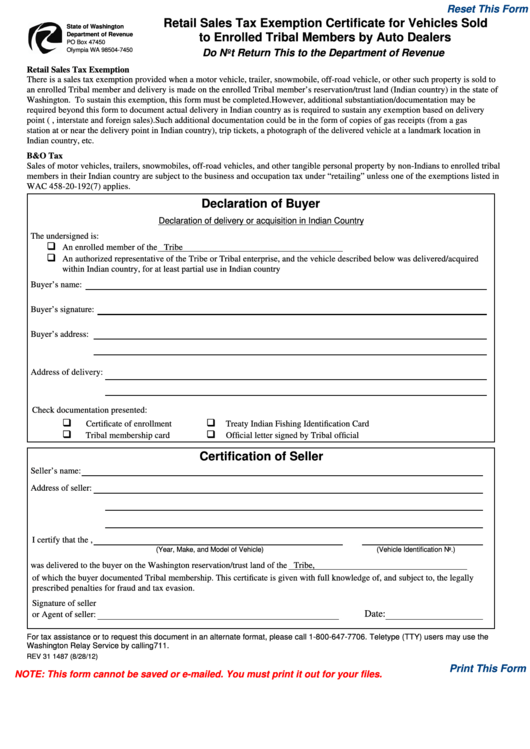

Fillable Rev 31 1487 Retail Sales Tax Exemption Certificate For

Utah Sales Tax Exemption Nonprofit Utah allows certain types of entities to be exempt from sales tax. Under utah law, a religious or charitable organization is exempt from sales tax at the point of sale when it makes purchases. Federally exempt 501(c)(3) organizations must obtain an n number (sales tax exemption number) from the utah state tax commission. Such entities include state and local government entities, federal. Many nonprofits can benefit from being exempt from sales tax on purchases of services, goods, and materials. Utah allows certain types of entities to be exempt from sales tax.

From www.northwestregisteredagent.com

TaxExemptions for Wholesale Buyers in UT Northwest Registered Agent Utah Sales Tax Exemption Nonprofit Such entities include state and local government entities, federal. Federally exempt 501(c)(3) organizations must obtain an n number (sales tax exemption number) from the utah state tax commission. Utah allows certain types of entities to be exempt from sales tax. Many nonprofits can benefit from being exempt from sales tax on purchases of services, goods, and materials. Under utah law,. Utah Sales Tax Exemption Nonprofit.

From www.signnow.com

Sales Tax Exemption Certificate New York 20112024 Form Fill Out and Utah Sales Tax Exemption Nonprofit Under utah law, a religious or charitable organization is exempt from sales tax at the point of sale when it makes purchases. Many nonprofits can benefit from being exempt from sales tax on purchases of services, goods, and materials. Federally exempt 501(c)(3) organizations must obtain an n number (sales tax exemption number) from the utah state tax commission. Such entities. Utah Sales Tax Exemption Nonprofit.

From www.taxuni.com

Utah Sales Tax 2023 2024 Utah Sales Tax Exemption Nonprofit Utah allows certain types of entities to be exempt from sales tax. Under utah law, a religious or charitable organization is exempt from sales tax at the point of sale when it makes purchases. Federally exempt 501(c)(3) organizations must obtain an n number (sales tax exemption number) from the utah state tax commission. Many nonprofits can benefit from being exempt. Utah Sales Tax Exemption Nonprofit.

From www.formsbank.com

Fillable Form Tc71m Sales And Use Tax Return Utah State Tax Utah Sales Tax Exemption Nonprofit Many nonprofits can benefit from being exempt from sales tax on purchases of services, goods, and materials. Under utah law, a religious or charitable organization is exempt from sales tax at the point of sale when it makes purchases. Utah allows certain types of entities to be exempt from sales tax. Federally exempt 501(c)(3) organizations must obtain an n number. Utah Sales Tax Exemption Nonprofit.

From www.udot.utah.gov

Utah State Tax Commission UDOT Utah Sales Tax Exemption Nonprofit Federally exempt 501(c)(3) organizations must obtain an n number (sales tax exemption number) from the utah state tax commission. Under utah law, a religious or charitable organization is exempt from sales tax at the point of sale when it makes purchases. Many nonprofits can benefit from being exempt from sales tax on purchases of services, goods, and materials. Utah allows. Utah Sales Tax Exemption Nonprofit.

From mavink.com

Sales Tax Exemption Certificate Utah Sales Tax Exemption Nonprofit Such entities include state and local government entities, federal. Under utah law, a religious or charitable organization is exempt from sales tax at the point of sale when it makes purchases. Utah allows certain types of entities to be exempt from sales tax. Federally exempt 501(c)(3) organizations must obtain an n number (sales tax exemption number) from the utah state. Utah Sales Tax Exemption Nonprofit.

From www.signnow.com

Blank Utah Tax Exempt Forms Fill Out and Sign Printable PDF Template Utah Sales Tax Exemption Nonprofit Under utah law, a religious or charitable organization is exempt from sales tax at the point of sale when it makes purchases. Many nonprofits can benefit from being exempt from sales tax on purchases of services, goods, and materials. Utah allows certain types of entities to be exempt from sales tax. Such entities include state and local government entities, federal.. Utah Sales Tax Exemption Nonprofit.

From www.formsbank.com

Fillable Rev 31 1487 Retail Sales Tax Exemption Certificate For Utah Sales Tax Exemption Nonprofit Under utah law, a religious or charitable organization is exempt from sales tax at the point of sale when it makes purchases. Such entities include state and local government entities, federal. Utah allows certain types of entities to be exempt from sales tax. Many nonprofits can benefit from being exempt from sales tax on purchases of services, goods, and materials.. Utah Sales Tax Exemption Nonprofit.

From taxfoundation.org

Utah Sales Tax Proposal Should Avoid Layering Taxes on Business Inputs Utah Sales Tax Exemption Nonprofit Under utah law, a religious or charitable organization is exempt from sales tax at the point of sale when it makes purchases. Many nonprofits can benefit from being exempt from sales tax on purchases of services, goods, and materials. Such entities include state and local government entities, federal. Utah allows certain types of entities to be exempt from sales tax.. Utah Sales Tax Exemption Nonprofit.

From www.exemptform.com

Utah Sales Tax Exemption Form Utah Sales Tax Exemption Nonprofit Many nonprofits can benefit from being exempt from sales tax on purchases of services, goods, and materials. Utah allows certain types of entities to be exempt from sales tax. Federally exempt 501(c)(3) organizations must obtain an n number (sales tax exemption number) from the utah state tax commission. Such entities include state and local government entities, federal. Under utah law,. Utah Sales Tax Exemption Nonprofit.

From www.templateroller.com

Form TC721A Fill Out, Sign Online and Download Fillable PDF, Utah Utah Sales Tax Exemption Nonprofit Many nonprofits can benefit from being exempt from sales tax on purchases of services, goods, and materials. Such entities include state and local government entities, federal. Under utah law, a religious or charitable organization is exempt from sales tax at the point of sale when it makes purchases. Federally exempt 501(c)(3) organizations must obtain an n number (sales tax exemption. Utah Sales Tax Exemption Nonprofit.

From www.pdffiller.com

Fillable Online Free fillable Tax Exempt Certificate TC721G, Utah Utah Sales Tax Exemption Nonprofit Utah allows certain types of entities to be exempt from sales tax. Federally exempt 501(c)(3) organizations must obtain an n number (sales tax exemption number) from the utah state tax commission. Many nonprofits can benefit from being exempt from sales tax on purchases of services, goods, and materials. Such entities include state and local government entities, federal. Under utah law,. Utah Sales Tax Exemption Nonprofit.

From www.exemptform.com

How To Get A Sales Tax Exemption Certificate In Utah Utah Sales Tax Exemption Nonprofit Under utah law, a religious or charitable organization is exempt from sales tax at the point of sale when it makes purchases. Many nonprofits can benefit from being exempt from sales tax on purchases of services, goods, and materials. Such entities include state and local government entities, federal. Federally exempt 501(c)(3) organizations must obtain an n number (sales tax exemption. Utah Sales Tax Exemption Nonprofit.

From www.golddealer.com

Utah State Tax Utah Sales Tax Exemption Nonprofit Such entities include state and local government entities, federal. Utah allows certain types of entities to be exempt from sales tax. Many nonprofits can benefit from being exempt from sales tax on purchases of services, goods, and materials. Federally exempt 501(c)(3) organizations must obtain an n number (sales tax exemption number) from the utah state tax commission. Under utah law,. Utah Sales Tax Exemption Nonprofit.

From www.dochub.com

Illinois tax exempt form Fill out & sign online DocHub Utah Sales Tax Exemption Nonprofit Utah allows certain types of entities to be exempt from sales tax. Such entities include state and local government entities, federal. Many nonprofits can benefit from being exempt from sales tax on purchases of services, goods, and materials. Federally exempt 501(c)(3) organizations must obtain an n number (sales tax exemption number) from the utah state tax commission. Under utah law,. Utah Sales Tax Exemption Nonprofit.

From www.pdffiller.com

Sales Tax Exempt Certificate Fill Online, Printable, Fillable, Blank Utah Sales Tax Exemption Nonprofit Utah allows certain types of entities to be exempt from sales tax. Many nonprofits can benefit from being exempt from sales tax on purchases of services, goods, and materials. Under utah law, a religious or charitable organization is exempt from sales tax at the point of sale when it makes purchases. Such entities include state and local government entities, federal.. Utah Sales Tax Exemption Nonprofit.

From www.pinterest.com

What Do Tax Exemption And W9 Forms Look Like? Groupraise In Free Resale Utah Sales Tax Exemption Nonprofit Such entities include state and local government entities, federal. Many nonprofits can benefit from being exempt from sales tax on purchases of services, goods, and materials. Under utah law, a religious or charitable organization is exempt from sales tax at the point of sale when it makes purchases. Federally exempt 501(c)(3) organizations must obtain an n number (sales tax exemption. Utah Sales Tax Exemption Nonprofit.

From digital.library.unt.edu

[Texas sales tax exemption certificate from the Texas Human Rights Utah Sales Tax Exemption Nonprofit Utah allows certain types of entities to be exempt from sales tax. Such entities include state and local government entities, federal. Many nonprofits can benefit from being exempt from sales tax on purchases of services, goods, and materials. Under utah law, a religious or charitable organization is exempt from sales tax at the point of sale when it makes purchases.. Utah Sales Tax Exemption Nonprofit.